Protecting Your Disabled Child

A Supplemental Needs Trust, also known as a Special Needs Trust, is a document that is designed to provide a way for you to leave part of some of your estate to a disabled child and still preserve the public assistance benefits provided by any county, state, federal or governmental agency. (This is usually Social Security and Medicaid). You may leave properties such as cash, stocks, bonds, life insurance proceeds and real property to the trust.

An important consideration is identifying the proper individual or entity to manage the trust after your death. This is the Trustee. This could be another family member, a close friend, or a trust company. Being appointed and serving as a Trustee is a very serious undertaking. Every Trustee is held to a high standard of performance, considerably higher than the performance acceptable for an individual’s own affairs. I recommend that the appointed trustee be part of the planning process so that the trustee duties are understood and accepted.

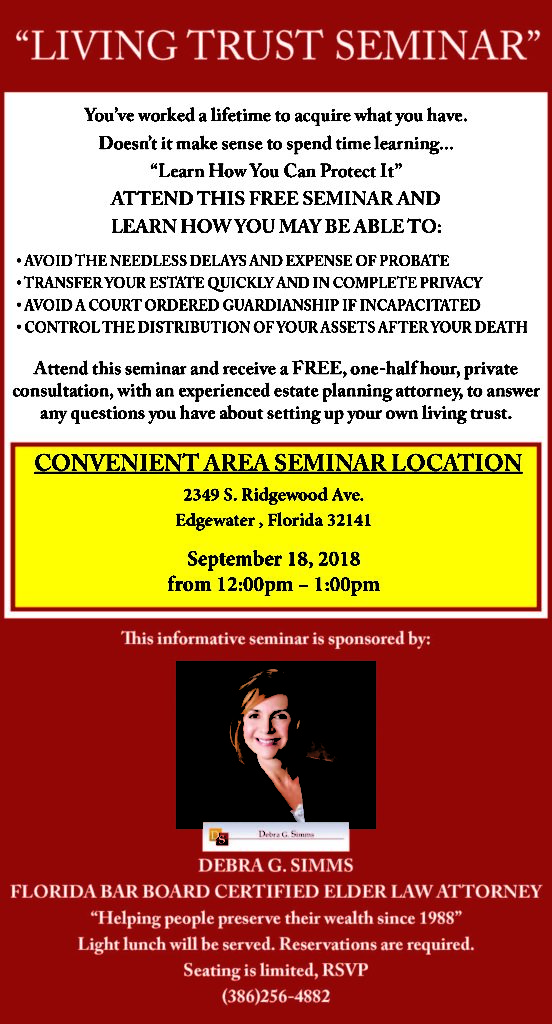

If you need advice on preparing such documents, call the Law Office of Debra G. Simms today at 386.256.4882

This blog post is not case-specific and is provided only for educational purposes and is not intended to provide specific legal advice. Blog topics may or may not be updated and entries may be out-of-date at the time you view them.